Hydrogen Fuel. Cleaner But Still More Expensive.

- Borrow2Share

- Mar 28, 2022

- 13 min read

Hydrogen As A Cleaner Fuel

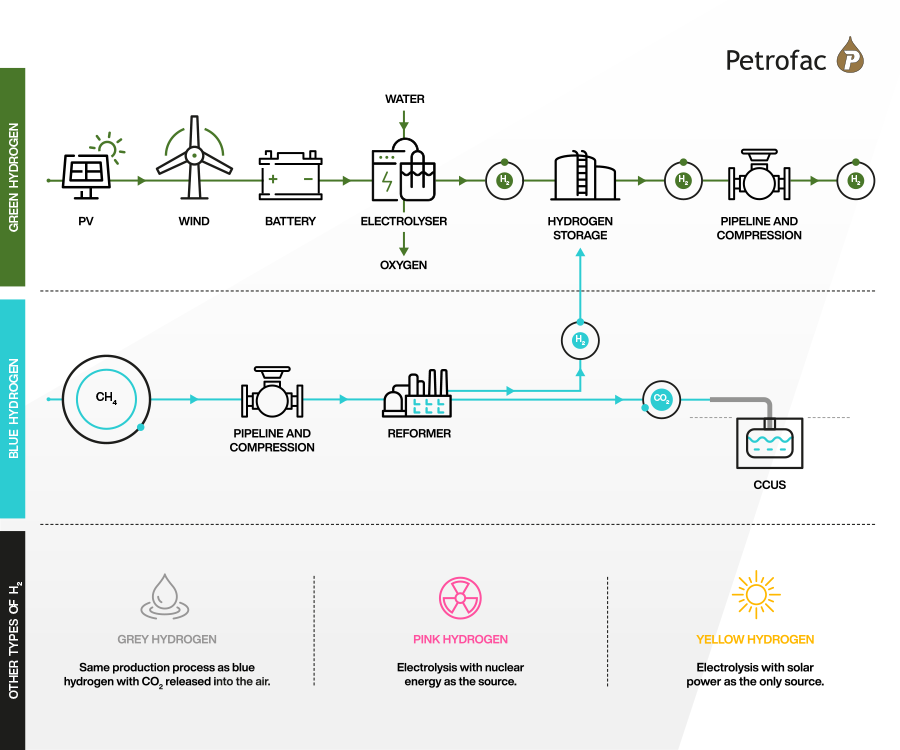

Hydrogen Is An Energy 'Carrier', Not An Energy Source. Hydrogen Stores and Carries Energy For Later Use. It Is Produced From Green (Zero-Carbon) or Non-Green (Low-Carbon) Energy Sources. Green Hydrogen vs. Blue Hydrogen. Versus Other 'Colors' of Hydrogen.

For 30 Miles = $3.50 Gasoline = $7.66 H2

Because 1 Kg H2 = $16.85 = 66 Miles and

1 Gal Gasoline = $3.50 = 30 Miles.

But 50% Cleaner Than Internal Combustion Engine (ICE).

Still Too Expensive For Consumer Cars. Better For Use Commercial Vehicles, Trucks, Etc.

https://www.petrofac.com/media/stories-and-opinion/the-difference-between-green-hydrogen-and-blue-hydrogen/

Hydrogen Fuel-Cell Vehicles

Battery pack: This high-voltage battery stores energy generated from regenerative braking and provides supplemental power to the electric traction motor.

Battery (auxiliary): In an electric drive vehicle, the low-voltage auxiliary battery provides electricity to start the car before the traction battery is engaged; it also powers vehicle accessories.

Fuel tank (hydrogen): Stores hydrogen gas onboard the vehicle until it's needed by the fuel cell.

Fuel cell stack: An assembly of individual membrane electrodes that use hydrogen and oxygen to produce electricity.

Power electronics controller (FCEV): This unit manages the flow of electrical energy delivered by the fuel cell and the traction battery, controlling the speed of the electric traction motor and the torque it produces.

Electric traction motor (FCEV): Using power from the fuel cell and the traction battery pack, this motor drives the vehicle's wheels. Some vehicles use motor generators that perform both the drive and regeneration functions.

Transmission (electric): The transmission transfers mechanical power from the electric traction motor to drive the wheels.

DC/DC converter: This device converts higher-voltage DC power from the traction battery pack to the lower-voltage DC power needed to run vehicle accessories and recharge the auxiliary battery.

Thermal system (cooling) - (FCEV): This system maintains a proper operating temperature range of the fuel cell, electric motor, power electronics, and other components.

Hydrogen Too Expensive For Consumer Cars Now.

A Better Fit For Commercial Vehicles, Trucks, Etc.

Consumer Cars. Fuel Cost Analysis. Followed by Carbon Emissions Analysis.

( https://cleantechnica.com/2019/04/26/hydrogen-cars-have-4x-annual-fuel-cost-2-70-times-the-carbon-debt-as-electric-vehicles/ )

Hydrogen Fuel and Scarce Infrastructure.

For a retail hydrogen pump in Sacramento on social media. The solitary pump, lonely in its sea of asphalt under a suitably gloomy sky, was charging $16.85 USD per kilogram of hydrogen.

Why is that important? Well, a kilogram of hydrogen is the energy equivalent of a gallon of gas. Hydrogen fuel cells are about three times as efficient at converting hydrogen to energy as internal combustion engines are at turning gasoline into energy, so you go about three times as far on a kilogram of hydrogen despite it having the same energy.

The Toyota Mirai gets about 66 miles per gallon out of its 5 kg fuel tank.

So really, you are paying about $5.50 to travel the same distance as you could with a $2.50 gallon of gasoline. Hmmm… in a car that costs a lot more than an internal combustion car too.

That might get better sometime, but maybe not. The best resource I found recently when structuring out an end-to-end air-to-fuel system to show why that’s such a poor idea, especially when fed with natural gas as Carbon Engineering does, is that mass production of clean hydrogen in the best case might get down to $5.00 per kg. That’s just the generation cost. That’s not storage, distribution, or markup, and is not the price a consumer would pay.

And hydrogen fuel pumps cost a million or two for a couple and more for the storage tanks. They are much more expensive than gas pumps, so hydrogen stations have to mark up the hydrogen a lot more than gas stations have to mark up the gas.

And those hydrogen stations don’t exist. They all have to be built on somebody’s nickel.

Meanwhile, making clean hydrogen is energy intensive and you throw away a lot of the energy. Let’s assume they get 10 MWh of electricity from a wind farm. Then they convert water to hydrogen and oxygen with the electricity. High-efficiency PEM electrolysis is about 80% efficient (projected to rise to a theoretical peak of 86%). That takes about 50 kWh per kilogram, so you have a couple of hundred kilograms of hydrogen.

You’ve thrown away 20% of the electricity and are left with 8 MWh embodied in the hydrogen.

Then you compress it, store it, ship it, and pump it. All of those things take energy. Let’s say another 10%. So now you have about 8 MWh in the 200 kg of hydrogen that you have spent 11 MWh on far.

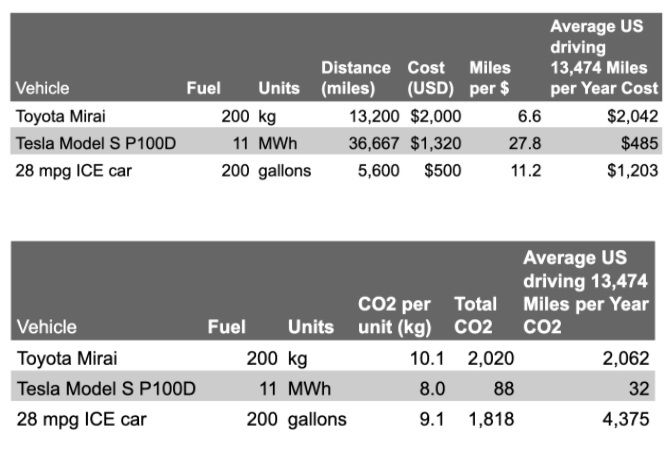

And then you put it in a Toyota Mirai at its best case 60% efficiency and throw away another 40%. That means you get 4.8 MWh of energy out of the 11 MWh you’ve spent. Those 200 kg will allow a Toyota Mirai to drive about about 13,000 miles. Let’s be nice and say the retail price of hydrogen gets down to $10 per kg. That will cost you $2,000 to drive those 13,000 miles.

What if you put that 11 MWh in to a Tesla Model S P100D? Well, that car travels about 100 miles for every 30 kWh of electricity you feed it. That means 11 MWh will allow a Tesla Model S to drive about 37,000 miles. That’s about three times as far for the same energy input. And the average cost of electricity in the USA (not the night time cost when you actually charge) is 12 cents per kWh, so those 11 MWh will only cost you about $1,300.

Just to finish this off, the gas car at 28 miles per gallon and 200 gallons will travel about 5,600 miles at a cost of about $500.

Yeah. The hydrogen-powered Mirai (if you could buy one where you are and if there were hydrogen pumps where you wanted to go, and neither of those things are true) would cost you about four times what just using the electricity would cost and almost twice what just driving a gas car would cost (and hydrogen cars are expensive of course).

Of course, this is the nicest possible way of making hydrogen. Most of it actually comes from steam reformation of natural gas, which has a CO2 debt of its own. The source I quickly found for steam reformation of hydrogen indicates that industrial processes emit 25,808 kgs of CO2 for every 2,551 kgs of hydrogen produced. As the authors from the Gas Research Division, Research Institute of Petroleum note: “In most cases CO2 is purged to the atmosphere because of its useless and harmful nature.“ So that’s not good. What does that look like over a year?

Gasoline produces about 9.1 kg of CO2 for every gallon. Wind energy produces about 8 kg per MWh full lifecycle including all mining, refinement, manufacturing, distribution, construction, operation and decommissioning (and that’s getting better as more of those elements decarbonize).

Yeah, hydrogen from steam reformation of natural gas is still better than burning gasoline, but that’s still a couple of tons of CO2 from the hydrogen process. And then you look at the wind energy (or solar) going into a Tesla battery and you say, wait a minute. Is that right? Would it really be that much better for the planet to drive a Tesla instead? And that much cheaper too?

Yes and yes.

Even if you just plugged into the wall in California, you’d still only be around 1,200 kg of CO2 per year and improving annually. CAISO just announced that California exceeded 100% of net demand from carbon-neutral electricity sources (wind, solar, hydro, and nuclear) for a bit over an hour on April 21, 2019. There are provisos on that, in that it was a low-demand period during the shoulder season, but that was 17 GW of low-carbon electricity pumping through the wires of California. If you’d been recharging your Tesla then, you would have been averaging about 12 kg CO2 per MWh, and you’d be under 50 kg CO2 for the year.

Gas stations make a couple of grand a week on gas typically, running about 3% profit margin on gasoline. Hydrogen pumps and tanks cost millions. Gas stations in cities are a dying breed because the only way for land that valuable to pay for itself is to build upward, and refueling stations with highly flammable substances require their own, single-story footprint. There’s no way to square that circle.

There are other reasons, but this is the reality of hydrogen for cars. It’s a dumb idea economically for individuals and it’s a dumb idea for the environment too.

It’s much, much better to decarbonize the grid and put that electricity into cars than into hydrogen. The slipperiest molecule might have a 3-4% transportation play in larger form factors (and maybe it will hold onto its forklift market for a while longer), but for cars it makes no sense.

Good For Use With Commercial Vehicles, Trucks, Etc.

The Benefits Of Hydrogen. Can Travel Much Farther. Quicker Refueling.

Use Bigger Tanks More Feasible Than Larger Heavier Batteries.

But, Fuel-Cell Electric Is ~85% Efficiency. Pure Battery Electric Is '100%' Efficiency.

Then, Internal Combustion Engine Is Only ~35% Efficiency!

( https://www.reuters.com/technology/german-auto-giants-place-their-bets-hydrogen-cars-2021-09-22/ )

Sept 22 (Reuters) - Battery power may be the frontrunner to become the car technology of the future, but don't rule out the underdog hydrogen.

That's the view of some major automakers, including BMW (BMWG.DE) and Audi (VOWG_p.DE), which are developing hydrogen fuel-cell passenger vehicle prototypes alongside their fleets of battery cars as part of preparations to abandon fossil fuels.

They are hedging their bets, calculating that a change in political winds could shift the balance towards hydrogen in an industry shaped by early-mover Tesla's (TSLA.O) decision to take the battery-powered road to clean cars.

Global auto hub Germany is in sharp focus. It is already betting billions on hydrogen fuel in sectors like steel and chemicals to meet climate targets, and closely-fought elections this month could see the Greens enter the coalition government and further push the technology.

BMW is hydrogen's biggest proponent among Germany's carmakers, charting a path to a mass-market model around 2030. The company also has one eye on shifting hydrogen policies in Europe and in China, the world's largest car market.

The Munich-based premium player has developed a hydrogen prototype car based on its X5 SUV, in a project already partly funded by the German government.

Jürgen Guldner, the BMW vice president who heads up the hydrogen fuel-cell car programme, told Reuters the carmaker would build a test fleet of close to 100 cars in 2022.

"Whether this (technology) is driven by politics or demand, we will be ready with a product," he said, adding that his team is already working to develop the next generation vehicles.

"We're on the verge of getting there and we're really convinced we'll see a breakthrough in this decade," he said.

VW's premium Audi brand told Reuters it had assembled a team of more than 100 mechanics and engineers who were researching hydrogen fuel cells on behalf of the whole Volkswagen group, and had built a few prototype cars.

HYDROGEN TOO COSTLY NOW

Hydrogen is viewed as a sure bet by the world's biggest truckmakers, such as Daimler AG (DAIGn.DE) unit Daimler Truck, Volvo Trucks (VOLVb.ST) and Hyundai (005380.KS), because batteries are too heavy for long-distance commercial vehicles.

Yet fuel cell technology - where hydrogen passes through a catalyst, producing electricity - is for now too costly for mass-market consumer cars. Cells are complex and contain expensive materials, and although refuelling is quicker than battery recharging, infrastructure is more scarce.

The fact that hydrogen is so far behind in the race to the affordable market also means even some champions of the technology, like Germany's Greens, favour prioritising battery-powered passenger cars because they see them as the fastest way to reach their main goal of decarbonising transport.

The Greens do, however, back the use of hydrogen fuel for ships and planes and want to invest heavily in "green" hydrogen produced solely from renewable sources.

"Hydrogen will play a highly important role in the transport industry," said Stefan Gelbhaar, the party's transport policy spokesperson in the Bundestag.

Politics can be unpredictable though - diesel went from saint to sinner following Volkswagen's Dieselgate emissions-cheating scandal, which came to light in 2015. Some carmakers view hydrogen technology as an insurance policy as the EU targets an effective ban on fossil-fuel cars from 2035.

Last year Daimler said it would wind down production of the Mercedes-Benz GLC F-CELL, a hydrogen fuel-cell SUV, but a source familiar with company plans said the project could easily be revived if the European Commission or a German government with Green participation decide to promote hydrogen cars.

"We're focusing on (battery) electric first, but we're in close cooperation with our truck guys," said Jörg Burzer, Daimler's head of production, when asked about that approach.

"The technology is always available."

180 KPH IN HYDROGEN X5

For years Japanese carmakers Toyota (7203.T), Nissan (7201.T) and Honda (7267.T), and South Korea's Hyundai, were alone in developing and pushing hydrogen fuel-cell cars, but now they have company.

China is expanding its hydrogen fuelling infrastructure, with several carmakers now working on fuel-cell cars, including Great Wall Motor (601633.SS), , which plans to develop hydrogen-powered SUVs.

The EU wants to build more hydrogen fuelling stations for commercial vehicles. Fitch Solutions auto analyst Joshua Cobb said the bloc was only likely to start pushing hydrogen passengers cars in two to three years' time, given it was still figuring out how to pay for its battery-electric car push and how to obtain enough "green" hydrogen from renewable sources.

But he added: "It's not out of bounds to think if the (German) Greens come into power they could accelerate the push to adopt regulations favouring hydrogen fuel-cell cars."

BMW's Guldner acknowledged hydrogen technology was too expensive to be viable for the consumer market today, but said costs would come down as trucking companies invested in the technology to bring fuel-cell vehicles to market at scale.

To demonstrate BMW's hydrogen X5 prototype, Guldner took Reuters for a spin at 180 km (112 miles) per hour on the autobahn near the carmaker's Munich headquarters and in a few minutes gave it enough fuel to run 500 km using a hydrogen gas pump at a Total petrol station.

Guldner said BMW saw hydrogen fuel-cell cars as "complementary" to its future battery electric model range, providing an alternative for customers who cannot charge at home, want to travel far and refuel swiftly. The motor in the hydrogen X5 is the same as BMW's all-electric iX.

"When the future is zero emissions, we believe having two answers is better than one," he added.

A LONG AND WINDING ROAD

Yet Fitch Solutions' Cobb said that it would still take years before any European policy support for hydrogen-powered cars translated into significant sales.

Indeed, auto consultancy LMC forecasts that various uses of hydrogen - in commercial vehicles, aviation and energy storage - would spur its adoption in passenger cars, but over the longer term.

"We're just not going to get there any time soon," said LMC senior powertrain analyst Sam Adham. LMC estimates in 2030 hydrogen fuel-cell models will make up just 0.1% of sales in Europe, and sales will only take off after 2035.

There remain divisions about the technology's prospects in the global car industry, and even within auto groups.

VW's Audi unit might be researching fuel cells, for example, but Volkswagen group CEO Herbert Diess has been scathing about hydrogen-powered cars.

"The hydrogen car has proven NOT to be the solution to climate change," he said in a tweet this year. "Sham debates are a waste of time."

Stephan Herbst, general manager of Toyota in Europe, has a different view.

Speaking in his role as a member of the Hydrogen Council business group, which forecasts that hydrogen will power more than 400 million cars by 2050, Herbst said he was confident that now governments had set ambitious carbon-reduction targets, they would push hydrogen alongside battery electric cars.

"We strongly believe this is not a question of either or," he added. "We need both technologies."

----------------------------------------------------------------------------------------------------------

( https://afdc.energy.gov/vehicles/how-do-fuel-cell-electric-cars-work )

Like all-electric vehicles, fuel cell electric vehicles (FCEVs) use electricity to power an electric motor. In contrast to other electric vehicles, FCEVs produce electricity using a fuel cell powered by hydrogen, rather than drawing electricity from only a battery. During the vehicle design process, the vehicle manufacturer defines the power of the vehicle by the size of the electric motor(s) that receives electric power from the appropriately sized fuel cell and battery combination.

Although automakers could design an FCEV with plug-in capabilities to charge the battery, most FCEVs today use the battery for recapturing braking energy, providing extra power during short acceleration events, and to smooth out the power delivered from the fuel cell with the option to idle or turn off the fuel cell during low power needs. The amount of energy stored onboard is determined by the size of the hydrogen fuel tank. This is different from an all-electric vehicle, where the amount of power and energy available are both closely related to the battery's size. Learn more about fuel cell electric vehicles.

----------------------------------------------------------------------------------------------------------

( https://afdc.energy.gov/fuels/hydrogen_basics.html )

Hydrogen (H2) is an alternative fuel that can be produced from diverse domestic resources. Although the market for hydrogen as a transportation fuel is in its infancy, government and industry are working toward clean, economical, and safe hydrogen production and distribution for widespread use in fuel cell electric vehicles (FCEVs). Light-duty FCEVs are now available in limited quantities to the consumer market in localized regions domestically and around the world. The market is also developing for buses, material handling equipment (such as forklifts), ground support equipment, medium- and heavy-duty trucks, marine vessels, and stationary applications. For more information, see fuel properties and the Hydrogen Analysis Resource Center.

Hydrogen is abundant in our environment. It's stored in water (H2O), hydrocarbons (such as methane, CH4), and other organic matter. One challenge of using hydrogen as a fuel is efficiently extracting it from these compounds.

Currently, steam reforming—combining high-temperature steam with natural gas to extract hydrogen—accounts for the majority of the hydrogen produced in the United States. Hydrogen can also be produced from water through electrolysis. This is more energy intensive but can be done using renewable energy, such as wind or solar, and avoiding the harmful emissions associated with other kinds of energy production.

Almost all the hydrogen produced in the United States each year is used for refining petroleum, treating metals, producing fertilizer, and processing foods.

Although the production of hydrogen may generate emissions affecting air quality, depending on the source, an FCEV running on hydrogen emits only water vapor and warm air as exhaust and is considered a zero-emission vehicle. Major research and development efforts are aimed at making these vehicles and their infrastructure practical for widespread use. This has led to the rollout of light-duty production vehicles to retail consumers, as well as the initial implementation of medium- and heavy-duty buses and trucks in California and fleet availability in northeastern states.

Learn more about hydrogen and fuel cells from the Hydrogen and Fuel Cell Technologies Office.

Hydrogen is considered an alternative fuel under the Energy Policy Act of 1992. The interest in hydrogen as an alternative transportation fuel stems from its ability to power fuel cells in zero-emission vehicles, its potential for domestic production, and the fuel cell's fast filling time and high efficiency. In fact, a fuel cell coupled with an electric motor is two to three times more efficient than an internal combustion engine running on gasoline. Hydrogen can also serve as fuel for internal combustion engines. However, unlike FCEVs, these produce tailpipe emissions and are less efficient. Learn more about fuel cells.

The energy in 2.2 pounds (1 kilogram) of hydrogen gas is about the same as the energy in 1 gallon (6.2 pounds, 2.8 kilograms) of gasoline. Because hydrogen has a low volumetric energy density, it is stored onboard a vehicle as a compressed gas to achieve the driving range of conventional vehicles. Most current applications use high-pressure tanks capable of storing hydrogen at either 5,000 or 10,000 pounds per square inch (psi). For example, the FCEVs in production by automotive manufacturers and available at dealerships have 10,000 psi tanks. Retail dispensers, which are mostly co-located at gasoline stations, can fill these tanks in about 5 minutes. Fuel cell electric buses currently use 5,000 psi tanks that take 10–15 minutes to fill. Other ways of storing hydrogen are under development, including bonding hydrogen chemically with a material such as metal hydride or low-temperature sorbent materials. Learn more about hydrogen storage.

California is leading the nation in building hydrogen fueling stations for FCEVs. As of mid-2021, 47 retail hydrogen stations were open to the public in California, as well as one in Hawaii, and 55 more were in various stages of construction or planning in California. These stations are serving over 8,000 FCEVs. California continues to provide funding toward building hydrogen infrastructure through its Clean Transportation Program. The California Energy Commission is authorized to allocate up to $20 million per year through 2023 and is investing in an initial 100 public stations to support and encourage these zero-emission vehicles. In addition, 14 retail stations are planned for the northeastern states, with some of those already serving fleet customers.

Vehicle manufacturers are only offering FCEVs to consumers who live in regions where hydrogen stations exist. Non-retail stations in California and throughout the country also continue serving FCEV fleets, including buses. Multiple distribution centers are using hydrogen to fuel material-handling vehicles in their normal operations. In addition, several announcements have been made regarding the production of heavy-duty vehicles, such as line-haul trucks, that will require fueling stations with much higher capacities than existing light-duty stations. Find hydrogen fueling stations across the United States.

Comments